Options trading is a dynamic aspect of financial markets, allowing investors to hedge risks and speculate on future price movements. In the Indian context, understanding the features, types, styles, payoffs, and valuation using models like Black-Scholes is crucial for effective participation.

Features of Options:

- Definition: Options are financial instruments that provide the holder with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price before or at the expiration date.

- Underlying Assets: Options can be based on various underlying assets, including stocks, indices, commodities, and currencies.

- Expiration Dates: Every option has an expiration date, after which it becomes void. Options can be short-term (weekly or monthly) or longer-term (quarterly or annually).

- Strike Price: The strike price is the pre-defined price at which the option holder can buy or sell the underlying asset.

Types of Options:

- Call Options: Give the holder the right to buy the underlying asset at the strike price.

- Put Options: Give the holder the right to sell the underlying asset at the strike price.

Option Trading Styles:

- European Options: Can be exercised only at expiration.

- American Options: Can be exercised at any time before or at expiration.

Payoffs from Options:

- Call Option Payoff: Payoff = max(0, Underlying Asset Price – Strike Price)

- Put Option Payoff: Payoff = max(0, Strike Price – Underlying Asset Price)

Valuation using Black-Scholes Model:

The Black-Scholes Model stands as a cornerstone in the realm of options pricing, providing a mathematical formula to estimate the fair market value of European-style options.

Key Components of the Black-Scholes Model:

- Underlying Asset Price (S): The current market price of the underlying asset.

- Strike Price (K): The pre-determined price at which the option can be exercised.

- Time to Expiration (T): The time remaining until the option’s expiration.

- Volatility (σ): A measure of the asset’s price variability over time.

- Risk-Free Interest Rate (r): The rate of return on a risk-free investment.

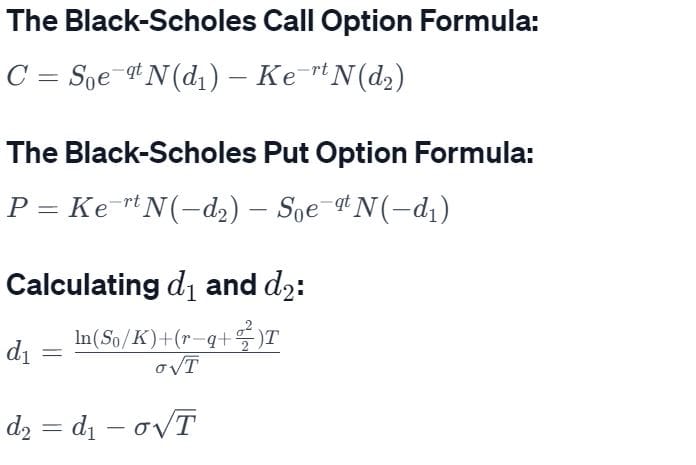

Understanding the Formulas:

- Call Option Formula:

- C represents the call option price.

- S0 is the current stock price.

- K is the strike price.

- e-qt accounts for dividends (if any).

- N(d1) and N(d2) are cumulative distribution functions.

- Put Option Formula:

- P denotes the put option price.

- e-rt discounts the future cash flow to present value.

- N(-d1) and N(-d2) are probabilities calculated from the standard normal distribution.

Practical Considerations:

- Implied Volatility: Traders often focus on implied volatility, representing market expectations about future price fluctuations.

- Dividend Yield (q): For stocks, the dividend yield is considered in the model, affecting call option pricing.

- Real-World Deviations: Market dynamics, transaction costs, and dividend payments may deviate actual option prices from Black-Scholes predictions.

Understanding the nuances of options trading, including their features, types, styles, payoffs, and valuation using models like Black-Scholes, empowers investors to navigate the complexities of the financial markets with precision and informed decision-making.